The relationship between Federal Reserve rate cuts and 10-year Treasury yields is far more complex than conventional wisdom suggests. While short-term rates move in lockstep with Fed policy, long-term yields—including the critical 10-year Treasury that serves as a benchmark for mortgage rates—are driven by a constellation of factors including inflation expectations, fiscal policy, and global capital flows.

Recent evidence demonstrates that rate cuts do not guarantee falling long-term yields, and in some cases, aggressive rate reduction proposals like President Trump's call for 1% rates could paradoxically drive long-term yields higher through fiscal dominance concerns and inflation expectations.

A Diverging Trend

Historically, Federal Reserve rate cuts have followed a predictable transmission mechanism. When the Fed lowers the federal funds rate, it typically signals economic weakness or the need for stimulus, leading investors to bid up longer-term bonds in a "flight to quality." This dynamic has historically created a strong correlation between short-term policy rates and longer-term yields.

However, this relationship has become increasingly unreliable. The Fed has cut policy rates by 75 basis points since September 2024 only to see longer-term Treasury yields and mortgage rates increase by the same degree. The 10-year Treasury yield has climbed from approximately 3.6% when rate cuts began to over 4.3% by late 2024. This divergence represents what RBC Wealth Management analysts describe as a modern "conundrum"—the inverse of the situation former Fed Chair Alan Greenspan faced when rate hikes failed to move long-term yields.

Expectations Framework

The expectations theory of the term structure provides crucial insight into this disconnect. Under this framework, long-term yields reflect the market's expectations of future short-term rates plus a term premium compensating investors for duration risk. When investors expect future short-term rates to be higher than current policy rates, long-term yields can rise even as the Fed cuts rates.

This explains why aggressive rate cut proposals like Trump's 1% target could prove counterproductive. If markets interpret such cuts as potentially inflationary or fiscally irresponsible, they may demand higher long-term yields to compensate for increased inflation and credit risk. The term premium—the extra return investors require for bearing interest rate risk—becomes especially important in this context.

Bond Vigilantes

Trump's proposal for 1% rates must be evaluated against the backdrop of unprecedented fiscal expansion. The One Big Beautiful Bill, which was recently signed into law, is set to increase the deficit despite claims to the contrary (see our piece A Signal of Dystopian Wealth Concentration).

This fiscal trajectory raises the specter of "fiscal dominance"—a regime where government fiscal pressures effectively dictate or constrain a country's monetary policy. Under fiscal dominance, the central bank's usual objective of controlling inflation becomes secondary to the Treasury's budget financing needs. Bond vigilantes—investors who sell government bonds in response to fiscal policies they view as inflationary or irresponsible—could drive up borrowing costs for the government. In June 2025, Jamie Dimon, CEO of JPMorgan Chase, highlighted that this possibility could come to fruition in the coming months.

The Quantitative Easing Paradox

Quantitative easing (QE) is a monetary policy tool used by central banks to stimulate economic activity, particularly when conventional methods like lowering interest rates are insufficient. It involves a central bank purchasing assets like government bonds from commercial banks, injecting more money into the financial system. QE decreases the yield on all long-term nominal assets, including Treasuries, agency bonds, corporate bonds, and MBS, with larger effects for longer-duration assets. However, when QE programs end or are tapered, the effects can reverse dramatically.

The 2013 "taper tantrum" demonstrated this dynamic powerfully. When Federal Reserve Chair Ben Bernanke announced that the Fed would begin reducing its bond purchases, the 10-year Treasury yield surged from around 2% in May 2013 to around 3% in December. This occurred despite no immediate changes to short-term rates, highlighting how expectations about future policy can drive long-term yields independently of current policy settings.

Inflation Expectations

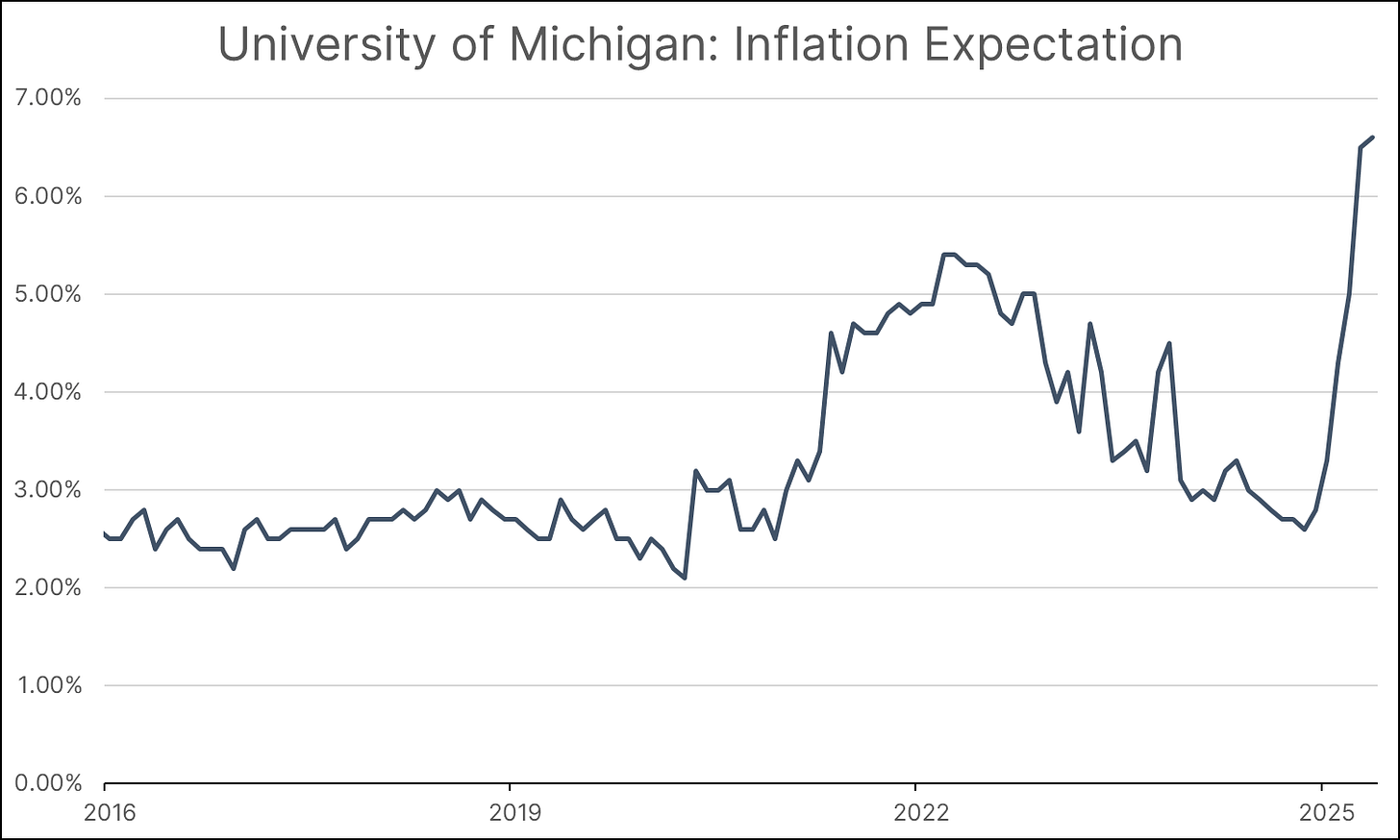

Current market conditions suggest elevated sensitivity to inflation concerns. Rising inflation expectations could discourage Fed rate cuts this year, as Fed officials have penciled in two rate cuts but are less likely to reduce rates if inflation expectations continue to drift higher. The median expectation of inflation over the coming 12 months jumped from 3.3 percent in January to 6.6 percent in May 2025 according to the University of Michigan's preliminary reading.

The term premium has risen, which we think is mostly a function of risk linked with holding dollar-denominated assets. This rise reflects growing concerns about the independence of the Federal Reserve, a development that only detracts from the attractiveness of holding Treasuries and dollars as a reserve asset.

Mortgage Rate Implications

The disconnect between Fed policy and long-term yields has particular significance for mortgage rates, which correlate with the 10-year Treasury yield more closely than with the federal funds rate. Mortgage rates typically follow the yield of the 10-year Treasury closely, with lenders setting mortgage rates based on the 10-year Treasury yield, typically adding 2-3% on top.

This means that even if the Fed were to cut rates to 1% as Trump proposes, mortgage rates might not decline meaningfully if the 10-year Treasury yield remains elevated or rises further. The only guarantee you get from a Fed rate cut is a lower prime rate, because they move in lockstep, benefiting products like home equity lines of credit but potentially having limited impact on the 30-year fixed mortgage market.

Policy Implications and Scenarios

Several scenarios could emerge from Trump's 1% rate proposal:

Scenario 1: Market Accommodation - If implemented gradually with credible fiscal restraint, markets might initially welcome lower rates. However, mortgage rates would likely remain elevated relative to the federal funds rate if long-term inflation expectations remain above target.

Scenario 2: Fiscal Dominance - If markets interpret the policy as evidence of political pressure on the Fed, bond vigilantes could emerge, driving long-term yields higher despite lower short-term rates. This would represent a classic case where the Treasury's spending habits for political purposes handcuff the Federal Reserve's attempts to manage inflation.

Scenario 3: Steepening Yield Curve - The most likely outcome would be a dramatic steepening of the yield curve, with short rates at 1% but long rates potentially rising above current levels due to inflation and fiscal concerns.

Conclusion

The relationship between Fed rate cuts and 10-year Treasury yields is neither automatic nor predictable. While traditional monetary transmission mechanisms suggest that rate cuts should lower long-term yields, this relationship breaks down when markets perceive threats to fiscal sustainability, central bank independence, or price stability.

Trump's proposal for 1% rates faces significant challenges in actually reducing long-term borrowing costs. Without addressing the underlying fiscal trajectory, aggressive rate cuts could paradoxically drive long-term yields higher through fiscal dominance effects and inflation expectations.

The current environment—characterized by elevated term premiums, rising fiscal deficits, and growing questions about Federal Reserve independence—suggests that bond markets are increasingly likely to punish policies that appear to subordinate monetary policy to fiscal expedience. In this context, the path to genuinely lower long-term rates likely requires credible fiscal restraint rather than simply aggressive monetary easing.

For policymakers and investors, the key insight is that yield curve dynamics in the current era are driven more by expectations about fiscal sustainability and inflation than by the level of short-term rates. This represents a fundamental shift from the post-financial crisis period when quantitative easing could reliably suppress long-term yields. As markets grapple with unprecedented debt levels and growing fiscal pressures, the traditional playbook for monetary policy transmission may prove increasingly obsolete.

If you enjoyed this write-up, you might also appreciate our other work—feel free to subscribe using the button below. Additionally, if you'd like to read our free monthly report covering the latest real estate and economic developments, visit our website to access the most recent edition!